November saw almost all of the index's watches decline.

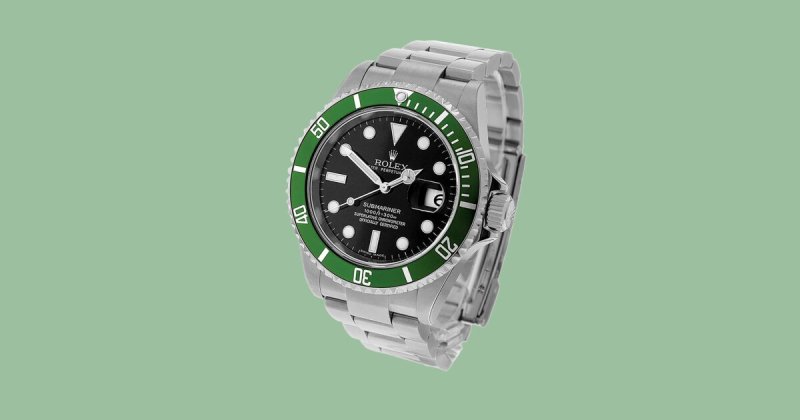

The most notable decliner was the discontinued Rolex Submariner Kermit ref. 16610LV, which had a green aluminum bezel and a black dial. It dropped 4.6% in just one month to $14,988.

The more contemporary Rolex Submariner, dubbed the Starbucks, has a current price of $15,659 on the index. It is still listed in the catalogue and has a black dial with a green ceramic dial.

The Starbucks is currently available for $10,800 at retail.

After sharp drops starting in the first quarter of 2022, prices on the secondary market stabilized in the first half of this year. However, the decline resumed in the summer, partly due to shorter waiting lists for models with limited supply.

The secondary market dealers that traded watches at ever-higher prices among themselves were a major factor in the rising prices that led to the peak in the second quarter of last year.

This cycle reversed when the market turned, with dealers unwinding their inventory to a diminishing group of possible trade and end-user customers.

As have been in a buyers' market since the beginning of the year, as evidenced by the data from the Bloomberg Subdial Watch Index for November.

The top 50 watch references that are traded the most on the pre-owned market make up the index. It takes into account the latest market price of each model, and is weighted according to their sales value.

The index price has decreased by nearly half from its peak of $60,000 in March 2022 to its current low of $34,000.

The more hype there was around a model during its heyday, the lower its value has fallen.

For instance, the index indicates that the discontinued Patek Philippe Nautilus 5711/1A-010 (a steel-on-steel three-hander with a date and a blue dial) was selling (or possibly promoting) for $140,000. On the Bloomberg Subdial Index, that price is currently under $80,000, but that represents a significant overestimation of the current market price.

In May, the most recent 5711 to be auctioned off at Watchcollecting.com sold for €65,000, or roughly $70,000. Since then, prices have remained mostly constant.

When the Audemars Piguet Royal Oak was discontinued, its value increased as well; at one point, it was selling for $105,000.

According to the Bloomberg Subdial index, the price is currently $65,000.

Once more, this is on the high side considering that the watch sold for €50,350 (roughly $54,000) in October during its most recent online auction on Watchcollecting.com.

Pre-owned specialist commentary accompanies the most recent Bloomberg Subdial index data. It suggests that demand was stifled by rising interest rates in the West, and that the end of fiscal tightening may have a knock-on effect on secondary market watch prices.

"The beginning of the US Federal Reserve's interest rate hikes coincides almost exactly with the decline in the secondary watch market in 20222. However, the relationship is more profound. There were greater rate increases and sharper declines in the watch market during the April–August [2023] period. Subdial suggests that after a brief period of both, there was another period of rate increases (and corresponding price declines) leading up to the end of the year.

The commentary continues, "As we look towards 2024, there is reason for optimism in the watch market as we potentially see a soft landing of stable and eventually declining rates."

Subdial cites the quantity of watches sold as additional cause for optimism. The prices at which watches are sold are still fluctuating. It states, "This is a sharp contrast to the previous year, when nobody knew what the prices should be and everyone decided to wait, causing the market to freeze."